Introduction: Leveling the Global Playing Field

In the buzzing marketplace of international trade, not every deal is fair. Some countries or manufacturers sell goods abroad at prices lower than what they charge at home—or sometimes even below the cost of production. This practice, known as dumping, can seriously hurt local industries. That’s where anti-dumping duties come in.

To combat this, countries like India use anti-dumping duties—a crucial tool in today’s volatile trade environment.

“Anti-dumping duties are not about protectionism. They’re about preserving fairness.”

So, What Exactly Are Anti-Dumping Duties?

Anti-dumping duties are tariffs imposed by a country on imported goods that are believed to be unfairly priced—i.e., sold below fair market value. These duties are designed to level the playing field between domestic producers and foreign exporters.

They are not about protectionism in the traditional sense, but rather about ensuring competition remains fair and industries aren’t wiped out by artificially low prices.

Let’s say Chinese manufacturers export aluminum wheels to India at prices that undercut Indian producers by 30%, even though Chinese domestic prices are higher. If an investigation confirms this constitutes dumping, India can—and often does—impose additional duties on those imports to offset the price gap.

Why Is It So Relevant Right Now?

The current economic scenario makes this topic particularly relevant. Here’s why:

- Global Slowdown and Overcapacity: In the post-pandemic world, many exporting countries—especially China—are facing sluggish domestic demand. To keep factories running, they export the surplus—often at low prices. Indian industries, from steel to chemicals to electronics, are facing this heat.

- Geopolitical Realignments: With shifting global alliances and the rise of “China+1” strategies, India is pushing to become a manufacturing alternative. But this transition is fragile. Dumped imports can cripple fledgling Indian industries just when they need nurturing.

- Make in India & Aatmanirbhar Bharat Goals: These flagship initiatives aim to boost domestic manufacturing and self-reliance. Dumping undercuts that. Imposing anti-dumping duties helps align trade policy with these broader economic goals.

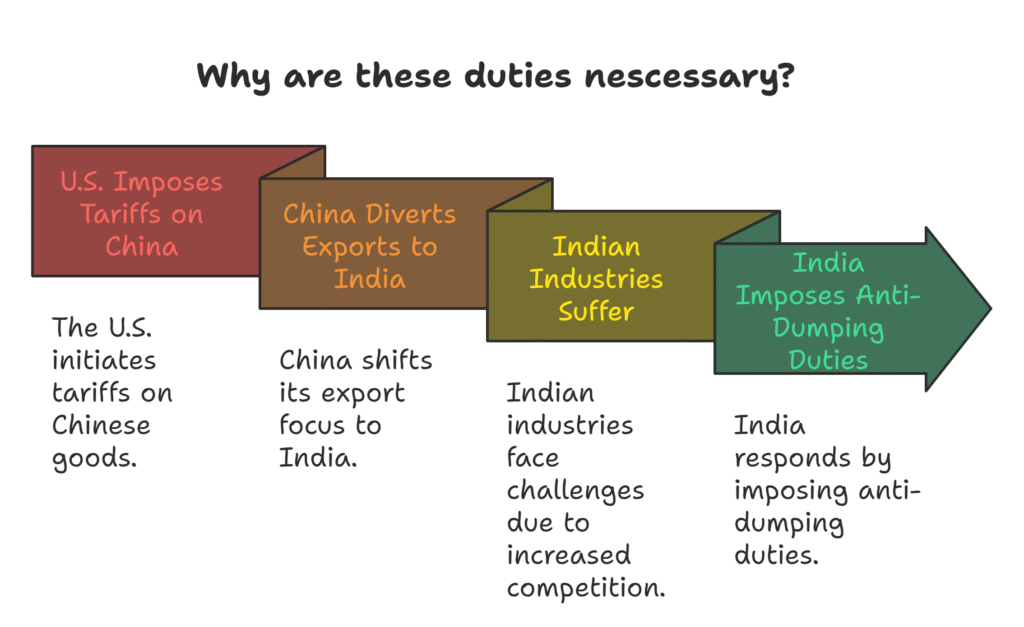

- And most importantly, How can we not mention the US-China Trade War:

Since the U.S.–China trade war began, the U.S. has slapped hundreds of billions of dollars worth of tariffs on Chinese goods. These tariffs are designed to penalize unfair trade practices and reduce the U.S. trade deficit with China.

As a result, Chinese exports to the U.S. have slowed in several sectors—electronics, steel, solar panels, chemicals, and more.

When one major door closes (like the U.S. market), exporters look for new ones. That’s where India—and other developing countries—come in.

China, facing:

- Excess manufacturing capacity,

- Rising inventory,

- Lower demand at home and in the West,

is turning to price-sensitive markets like India to dump its goods—often at prices below cost, just to offload stock and maintain factory output.

This is why anti-dumping cases in India have increased, especially in sectors already affected by U.S. tariffs (like solar glass, chemicals, and base metals).

So yes—India’s anti-dumping measures are very much a ripple effect of global trade dynamics, especially the long-standing U.S.–China tariff battle.

“You can’t build an industrial economy if you let unfair imports wipe out your factories.”

Pros of Anti-Dumping Duties

✔ Protect Domestic Industries

Gives Indian manufacturers breathing room to compete fairly.

✔ Preserve Jobs

Without duties, job losses in manufacturing could spike dramatically.

✔ Enforce Fair Trade Norms

They signal to global exporters: compete clean, or pay the price.

✔ Boost Strategic Sectors

Supports sensitive industries like renewables, pharma, and electronics.

No, these duties, like most other tools does not come without downsides;

Let’s quickly scan the risks and challenges of anti-dumping import duties.

Cons and Challenges

❌ Price Hikes for Consumers

Higher tariffs can mean more expensive goods, especially in electronics and everyday items.

Yes, that would mean your favourite device might get more expensive. Further, additional duties on chemicals might spike the home paints.

❌ Slow Reaction Time

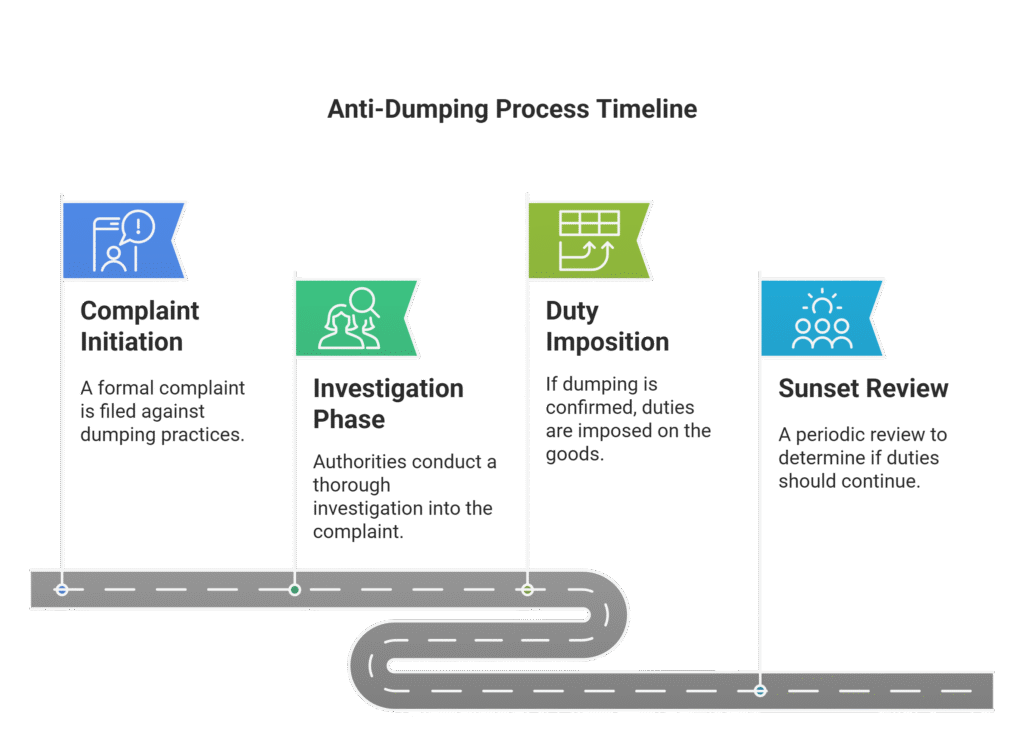

Investigations by the DGTR often take 12–18 months, sometimes more.

By then, much of the damage is already done. Several small and medium enterprises (SMEs), which, btw, form the backbone of Indian manufacturing, may not survive long enough to see relief.

❌ Risk of Trade Tensions

There’s criticism that India sometimes hesitates to impose duties, fearing diplomatic or trade backlash.

For example, despite multiple investigations confirming dumping from certain ASEAN countries, duties have been postponed or reduced.

In sectors like solar manufacturing, this has had devastating effects. Indian solar panel makers struggled for years under a flood of cheap imports, mainly from China. While duties were eventually imposed, several domestic players had already exited the market by then.

❌ Scope for Misuse

Yes, every market has its backstage crew pulling a few strings!

If used excessively, duties can lead to inefficiency and complacency among protected firms.

Finding the Balance

India must strike a careful balance—protecting its industries without creating barriers that hurt consumers or economic dynamism. Duties should come with:

- Sunset clauses (expiry after 5 years unless renewed),

- Periodic reviews,

- Performance tracking for beneficiaries.

“Anti-dumping duties are a shield, not a comfort blanket.”

Conclusion: A Timely, Tactical Move

With India positioning itself as a global manufacturing hub, anti-dumping duties aren’t just policy—they’re economic defense mechanisms. The key is using them smartly: quickly, fairly, and strategically.

“Used right, anti-dumping duties won’t isolate India—they’ll empower it.”

P.S:- Share your thoughts in the comment.