In a retail landscape where most eyes focus on metropolitan breakthroughs, V2 Retail quietly achieved a staggering 238% stock growth in just one year. This remarkable performance contrasts sharply with the broader market narrative and highlights a fascinating retail dichotomy: while urban markets saturate, Tier II and III cities in India are experiencing retail growth rates of approximately 50%, more than double the 20% seen in metros. This disparity represents both an opportunity and a challenge that defines V2 Retail’s journey.

About the company

Founded in 2011, V2 Retail has established itself as one of India’s fastest-growing retail companies, with 96 high-fashion operational stores spread across 17 states. The company primarily operates in Tier II and Tier III cities, offering apparel and general merchandise catering to entire families.

With 11 lakh square feet of retail space under management, V2 Retail has positioned itself as a value provider in markets traditionally underserved by organized retail.

At the helm stands Ram Chandra Agarwal, whose retail acumen was previously demonstrated when he took Vishal Retail public in 2007. Under current CEO Akash Agarwal’s leadership, the company has sharpened its focus on providing “value and variety” – a positioning that resonates particularly well with non-metro consumers.

The Numbers:

Let’s look into some of it’s numbers from balance sheet & Income Statement:

Key Data Points

Average Selling Price (ASP): 293 in FY25 vs 263 in FY24

Average Bill Value (ABV): 853 in FY25 vs 798 in FY24

Sales per Square Feet (PSF) per Month: 1,069 in FY25 vs 862 in FY24

The company’s financial trajectory tells a compelling story of growth potential in overlooked markets.

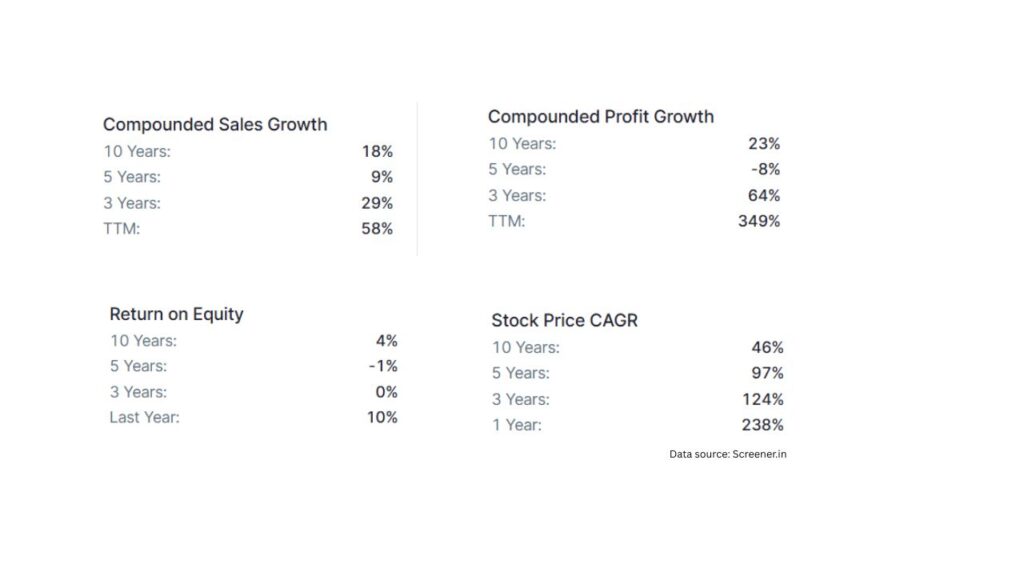

With revenue reaching ₹1,682 Cr and profits of ₹68.1 Cr in the most recent reporting period, V2 Retail boasts an impressive 10-year compounded sales growth of 18%, accelerating to 58% in trailing twelve months.

These numbers aren’t just impressive – they’re indicative of a deeper market shift.

Now Let’s Dive deep into the reason behind such staggering growth.

Industry & Market Analysis

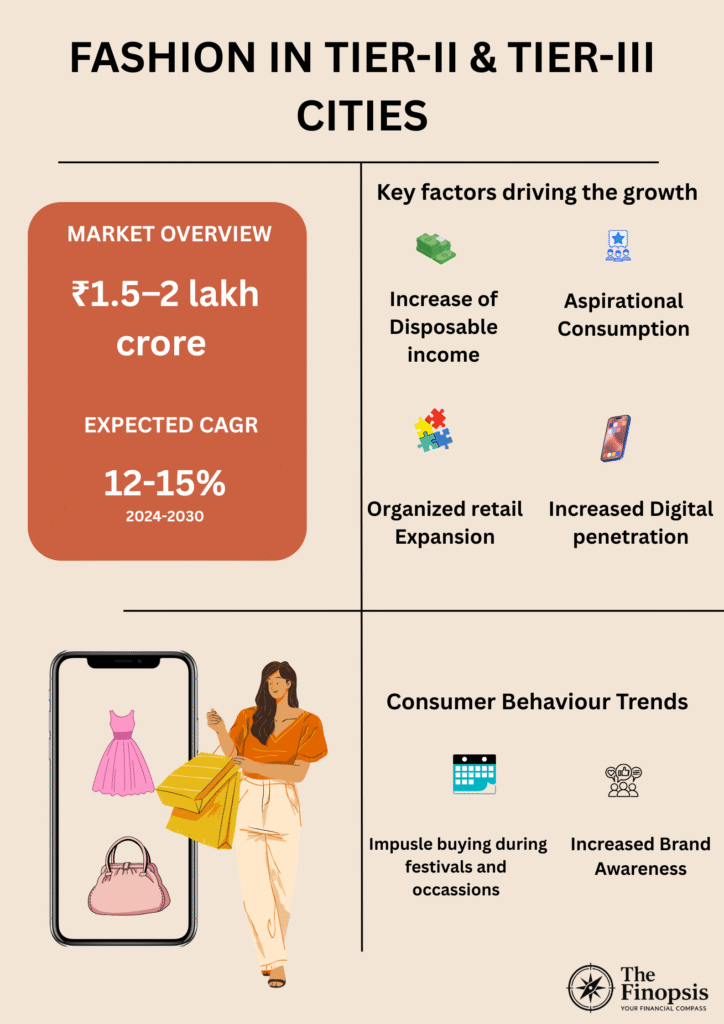

The fashion industry in India’s tier-II and tier-III cities is witnessing rapid growth, far more than the metro cities. They are emerging as a key driver of the country’s retail expansion.

As metros reach saturation, brands are increasingly targeting smaller cities, where rising disposable incomes, urbanization, and aspirational lifestyles are fueling demand for affordable fashion.

Estimated to be worth ₹1.5–2 lakh crore in 2024, this market is expected to grow at a CAGR of 12–15% through 2030, outpacing metro markets. Much of this growth is rooted in a shift in consumer behavior—residents of these cities are transitioning from price-sensitive to value driven.

They are becoming increasingly brand-aware.

Credit: Social Media.

Simultaneously, digital penetration through affordable smartphones and 4G access has enabled a surge in online shopping, with platforms like Meesho, Flipkart, and Myntra reporting that over 60% of their orders now come from non-metro regions.

But, E-commerce giants are struggling to fulfil the needs of these emerging customers. Thanks to high logistics and return costs.

In such scenario, brands that can localize offerings (such as: customized offers in occasions, wedding season, etc.), leverage private labels for margin control, and blend online and offline experiences through Omni channel strategies stand to gain a significant advantage.

This type of marketing is called the Guerrilla Marketing. Yes, knowing your local customers can make you millions.

As Jack Ma once addressed Amazon and said: “You might be the shark in the ocean, but I am the crocodile in the Nile.”

Market Positioning

Question is, How did V2 Retail capitalize on this market?

Manufacturing & Designing

The company has an in-house team of 25 designers for creating the products that are manufactured in its facilities at Noida & Bihar. It has its warehouse in Gurgaon. The company has its fleet of vehicles to refill the inventory at stores once a week.

This gives the company freedom of personalizing items according to the customers’ preference.

Private Label Business

The company derives 35% of its revenue from its private label products and it intends to increase it to 80% by FY26.

E – Commerce

They have tie-ups with prominent e-commerce players, such as Amazon and Myntra along with the launch of its e-commerce portal—V2kart—to diversify its sales channel. However, the revenue contribution from these has remained minimal in recent years.

Subsidiary

In 2019, the company established in-house capacity for manufacturing its private label apparel under a wholly-owned subsidiary, V2 Smart Manufacturing Private Limited, to achieve better cost control and quality. At present, VRL can meet 15-20% of its apparel requirements captively from its subsidiary.

FY26 Growth Plans

The company plans to open 100 stores in FY26 with the majority of the capex to be funded through internal accruals.

P.S: You can go through their quaterly report by clicking here.

The true significance of V2 Retail’s growth lies in its human impact, especially, people living in Tier-II, tier-III cities who previously had to travel hours to access branded apparels.

One of their customers explained and I quote:

“Having a store like V2 locally means my family can experience fashion trends without the travel burden”

For millions like him, V2 Retail represents accessibility to organized retail that was previously unavailable.

For local economies, each new store creates approximately 40-50 jobs while developing retail skill sets in regions where service-sector employment has traditionally been limited.

This ripple effect contributes to broader economic development in these regions.

However, beneath this growth story lie significant operational challenges. The company faces difficulties including:

- Extended supply chains: Higher delivery costs due to geographic dispersion of stores across 17 states.

- Inventory management inefficiencies: Balancing stock across diverse regional preferences presents complex forecasting challenges.

- Vendor management complications: Product sourcing remains challenging in terms of vendor selection and quality control.

- Unique customer behavior: Non-metro consumers display significantly different purchasing patterns – they’re more price-sensitive, less experimental with online purchases, and less comfortable with digital transactions.

The director of V2 fashion himself comes up and adresses some of these parameters. Click here to check the full article.

The company’s current return on equity stands at 10.4%, showing reasonable profitability, but its stock trades at 20.1 times book value – suggesting high growth expectations that require addressing these fundamental challenges17.

Strategic Imperatives for Sustained Growth

For V2 Retail to maintain its impressive trajectory, the following measures could be taken:

- Localized inventory intelligence systems: Implementing AI-driven demand forecasting that accounts for regional variations could significantly reduce the 155 inventory days currently on the books. Imagine an infographic showing how regional preferences vary across store locations, with heat maps indicating demand patterns by geography.

- Hub-and-spoke distribution: Establishing regional distribution centers could reduce transportation costs while improving delivery times. Visualize this through a map showing optimal distribution center placements across V2’s footprint.

- Omnichannel adaptation: While non-metro consumers are less digitally engaged, developing a gradual digital onboarding strategy could create competitive advantage. Picture a customer journey infographic showing the transition from in-store to online shopping over time.

- Vendor consolidation program: Creating stronger relationships with fewer, more reliable suppliers could streamline operations while ensuring quality consistency. An infographic could illustrate the before-and-after of a vendor network optimization.

All the big retail players such as Wallmart, D-Mart, Reliance Smart, Trends were among the first adoptors of these measures.

The SWOT (Strength-Weakness-Opportunity-Threat) Analysis:

Conclusion

V2 Retail stands at an inflection point. With North India projected to account for 44% of upcoming retail supply in Tier II and III cities over the next five years, the company faces both unprecedented opportunity and intensifying competition.

The fundamental question for retail leaders, investors, and market observers becomes:

Can V2 Retail leverage its first-mover advantage and deep understanding of non-metro consumers? or

Will operational challenges and Giant competitors erode its current momentum?

The answer will not only determine the company’s trajectory but also shape the retail experience for millions of Indians outside metropolitan centers. The small-town retail revolution is underway – and V2 Retail’s ability to solve its structural challenges while maintaining its value proposition will determine whether it leads this revolution or simply participates in it.

Are you considering being bullish on this company?