Introduction

An FD is a low-risk financial product offered by banks and financial institutions where you deposit a lump sum of money for a fixed period (e.g., 7 days to 10 years) at a fixed interest rate. Unlike regular savings accounts, the interest rate is higher and guaranteed, but your money is “locked in” until maturity.

Why FDs are traditionally seen as “safe” investments?

What is considered as a safe investment?

Yes, you guessed it right! If my principal amount is safe.

And, FD offers just that!

Here’s the catch —- FDs are offered by banks, which are regulated institutions. Thus, these deposits are insured up to a certain amount, like the FDIC in the US or DICGC in India. That insurance protects the principal even if the bank fails.

Another factor is the guaranteed returns.

Unlike stocks or mutual funds, FDs have a fixed interest rate, so there’s no market risk. The returns are predictable. Since the principal is returned at maturity, it’s safe from market fluctuations.

Also, FDs are low complexity. They don’t require market knowledge, making them accessible to risk-averse investors. The historical perception plays a role too; people have trusted banks for a long time, so FDs are seen as a default safe option.

Secured Capital, Ensured Returns that too without any headache!

Sounds like a safe harbour in this unpredictable financial world, right?

However, the very factors that make FDs appealing during normal times can turn into significant disadvantages during periods of high inflation and market downturns.

Curious? Strap in — we’re about to break it down.

But before that, we need to address an important question:

How does FDs work?

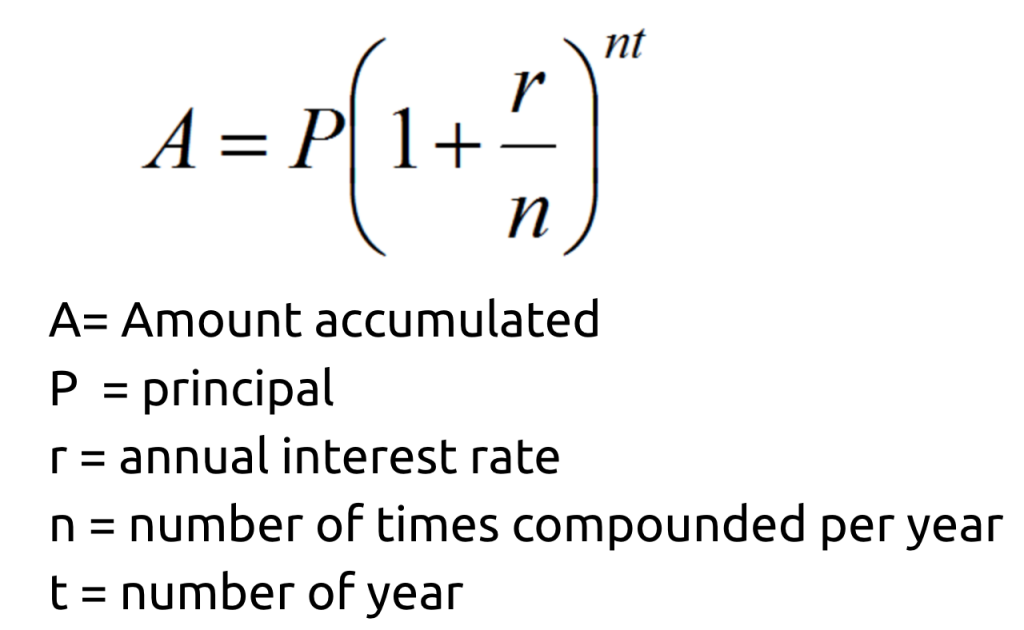

Let’s assume you deposit ₹100,000 in a one-year FD. First, you pick your tenure—say 12 months—and the bank locks in an annual rate (let’s use 6.5% p.a. for our example). Interest is compounded quarterly, so every three months your balance grows slightly more. By year-end, your maturity amount would be calculated as:

Which comes around ₹106,693

If you chose a cumulative FD, you’d get this lump sum at the end;

If you’d opted for quarterly payouts, you’d have received roughly ₹1,616 every three months instead.

Need your money early?

You can break the FD, but the bank will knock off about 0.5%–1% from the rate as a penalty, and pay you the “broken-FD” rate instead. On maturity, you can instruct the bank to renew the ₹106,693 at the then-prevailing rate—or you can withdraw it all and move on.

In short, your ₹100,000 works predictably for you—growing at a fixed rate with known compounding—but it stays locked in unless you’re willing to pay to get it back. This blend of safety, predictability, and liquidity constraint is what makes FDs so appealing… But, in certain economic climates, potentially limiting.

The Impact of Inflation on Fixed Deposits

Although FDs are considered to be a very lucrative investment, lurking beneath their apparent security is a stealthy adversary: INFLATION.

Inflation is the rise in prices of goods and services over time, reducing your purchasing power.

Why it matters for savings: If your savings don’t grow faster than inflation, their real value (what you can actually buy) shrinks.

Example:

If inflation is 5% annually, ₹100 today will only buy goods worth ₹95 next year.

If your FD earns 6%, your real return is just 1% (6% – 5%)

Real Returns vs. Nominal Returns

Nominal Return: The stated interest rate (e.g., 6% FD).

Real Return: Nominal return minus inflation.

Formula: Real Return = Nominal Return − Inflation Rate

Example:

FD nominal return = 7%

Inflation = 6%

Real return = 1% (barely preserving wealth).

How Inflation Eats into FD Returns

Example:

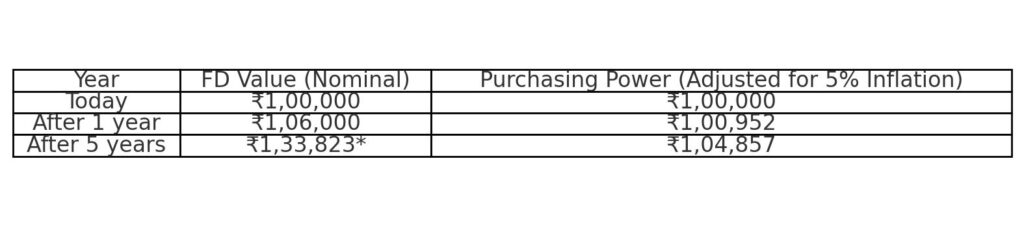

FD Amount: ₹1,00,000

FD Rate: 6% per annum

Tenure: 5 years

Inflation: 5% per annum

Result:

Nominal gain: ₹33,823.

Real gain: Only ₹4,857 after adjusting for inflation.

Effective annual real return: ~0.95% (barely breaking even).

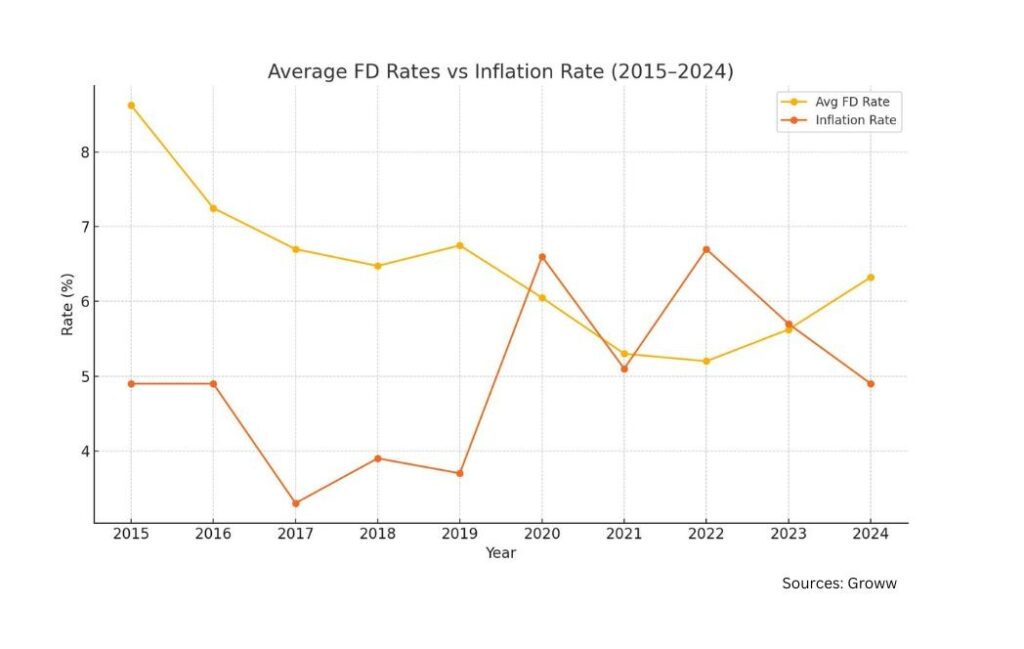

Moreover, if we look at the Historical Perspective: FD Returns vs. Inflation (India), we can see that:

Let alone beating the inflation, FDs, in some years, have given negative effective returns.

This means that even if you have kept your money in the bank’s most secure locker (i.e, FDs), Your money would have depreciated in value.

Uh-ohhh! Are we ruining the image of the “Safe heaven investment” for many?

Wait for the shockers coming up in the next section.

Tax Implications That Further Reduce FD Gains

Fixed Deposits (FDs) already offer modest returns, but taxation can significantly erode these gains. FD interest isn’t treated specially — it’s taxed as regular income based on your slab rate.

So, if you’re in the 30% tax bracket, a 7% FD shrinks to just 4.9% after taxes. And that’s before inflation even steps in!

When you stack inflation on top of taxation, the so-called “safe” gains barely hold their ground — in fact, they often lose purchasing power over time.

Even if you’re in a lower tax bracket, the double whammy of taxes and rising prices leaves little room for real wealth creation.

Bottom line, relying on FDs for long-term financial goals could mean running hard just to stay in the same place.

Liquidity: The Hidden cost of FDs

Liquidity constraints bite during crises: premature withdrawals trigger penalties.

It amplify risks: premature withdrawals incur penalties (e.g., forfeited interest).

This forces the investor to choose between financial losses or emergency needs.

Wait, there’s more to it….

The Opportunity Cost.

By locking money in FDs, investors basically sit out the sale of the decade.

While the stock market and real estate go “on discount” during downturns, FD holders are stuck earning fixed returns that barely stretch beyond inflation.

It’s like choosing to stay in a slow-moving boat while speedboats (read: equities and real estate) are zipping past on the rebound.

Markets bounce back with a roar — but your FD?

It just hums quietly in the corner, missing all the action.

#Personal Opinion

While we have already discussed how FDs have a risk if eroding out your wealth, the question arises:

What should the investors do?

Enter: Index Funds

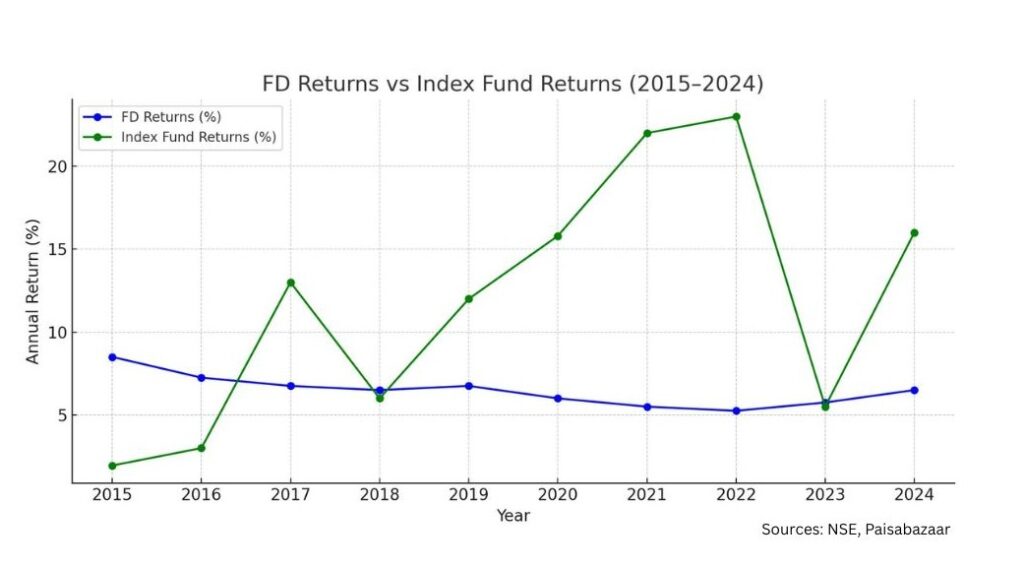

Low-cost, market-linked, and historically proven to outpace both inflation and traditional savings instruments.

While FDs give you 6–7% (before tax), Index Funds — which track benchmarks like the Nifty 50 or Sensex — have delivered 10–12% average annual returns over the past two decades.

And even though they move with the market, time tends to smooth out the bumps. Over 7–10 years, Index Funds have consistently beaten FDs, and often by a wide margin.

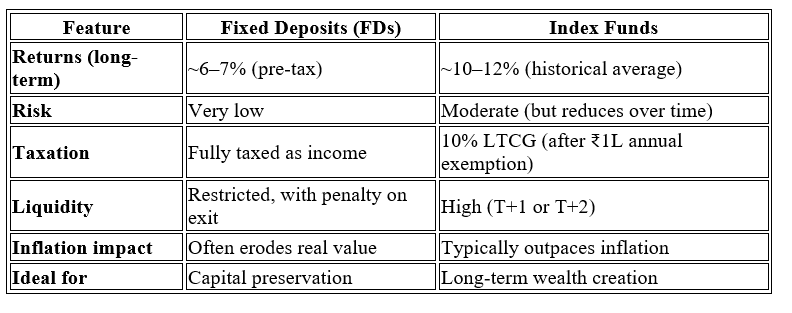

Here are the key comparison of FDs and Index Funds, summed up for you:

When Does Fixed Deposits Still Make Sense?

While Fixed Deposits (FDs) have limitations in beating inflation or generating wealth, they remain a valuable tool in specific scenarios. Here’s where they shine:

Senior Citizens: Banks often offer 0.25–0.75% higher FD rates to seniors, providing stable, risk-free income for retirees who prioritize capital safety over aggressive growth.

Short-Term Parking of Funds: For goals within 1–2 years (e.g., saving for a car, vacation, or emergency fund), FDs offer better returns than savings accounts without exposing money to market volatility.

Specific Financial Goals: When timelines are fixed and predictable (e.g., a wedding or tuition fee due in 18 months), FDs ensure the principal is intact and accessible at maturity.

Diversification: As a low-risk component of a broader portfolio, FDs balance riskier assets like stocks or crypto. For example, parking 20–30% of savings in FDs provides stability during market crashes.

Conclusion

Playing It Safe Could Be Costing You More!

In a world where inflation is quietly eating into your savings and market downturns are opening doors for long-term growth, sticking all your funds in Fixed Deposits is like bringing a spoon to a sword fight. Sure, FDs offer stability, but they often lack the firepower to preserve—let alone grow—your wealth meaningfully over time.

The real risk today isn’t market volatility; it’s missed opportunity.

So, while it’s okay to keep a slice of your portfolio in FDs for short-term needs, don’t let “safety” become your excuse for stagnation.

It’s time to rethink where your money sleeps—and whether it’s actually working for you.