From IPO rookie to renewable rockstar—Waaree Energies is shining bright in India’s solar revolution. Since its listing in October 2024, the stock has doubled, leaving investors and analysts both impressed and curious:

What’s fueling Waaree’s meteoric rise—and can it last?

Let’s dive into this solar success story, unpacking numbers, strategy, and the broader energy transformation it’s helping lead.

🔍 1. Blazing Growth: What the Numbers Tell Us

Waaree’s Q4 FY25 performance wasn’t just good—it was groundbreaking. A 36% YoY revenue jump (₹4,004 crore), module volumes up 52%, and EBITDA more than doubling to ₹923 crore. This isn’t luck—it’s scale, strategy, and timing.

What’s behind the numbers?

- Strong domestic demand: From rooftop solar to industrial parks, India’s hunger for renewable energy is growing.

- Efficient operations: Cheaper raw materials and smart supply chain moves have expanded margins.

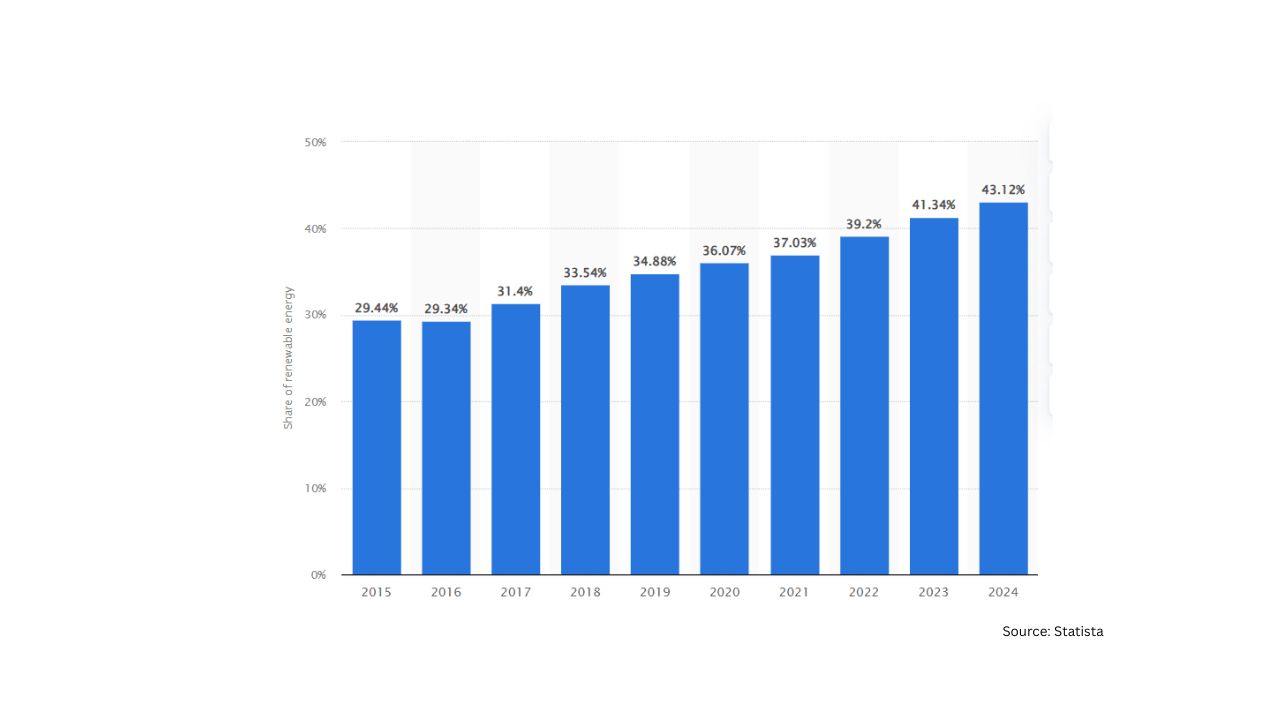

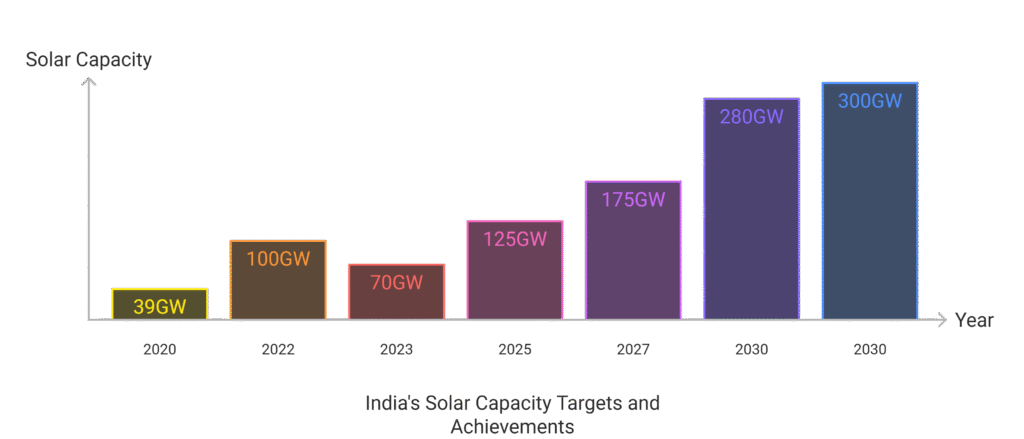

From the above graph, it is clear that India is marching towards cleaner and sustainable sources of energy, aggressively.

And….

Solar energy leads the march!

🧩 2. Big Bets on Backward Integration

Unlike many solar players that rely on imported components, Waaree is becoming self-sufficient—fast. Its new 5.4 GW solar cell facility in Gujarat gives it tighter control over production and pricing.

Why this matters:

- Less exposed to global price swings

- Higher margins through in-house sourcing

- Stronger compliance with India’s DCR (Domestic Content Requirement) mandates

This isn’t just a smart move—it’s a moat.

🌎 3. Geopolitical Tailwinds: India Over China?

With global supply chains under scrutiny and U.S. tariffs hitting Chinese solar exports, Waaree is perfectly positioned.

✅ India’s PLI scheme incentivizes local production

✅ The U.S. Inflation Reduction Act (IRA) is shaky—but Waaree has a local facility in Texas

✅ International clients are diversifying away from China, and Waaree is the biggest player in the world’s most trusted “China+1” destination

💥 4. The Mega Order Book—And What It Really Means

A 25 GW order book might sound abstract. Let’s put it in perspective:

- India’s entire installed solar capacity in 2023 was ~73 GW.

- Waaree alone has booked capacity equivalent to over one-third of that.

But it’s not just about size—it’s about mix:

- Retail orders (1–2 month execution cycle) = fast cash flow

- Utility-scale projects (9–12 month cycle) = long-term revenue anchors

- Overseas orders (esp. Middle East & Europe) = diversification hedge

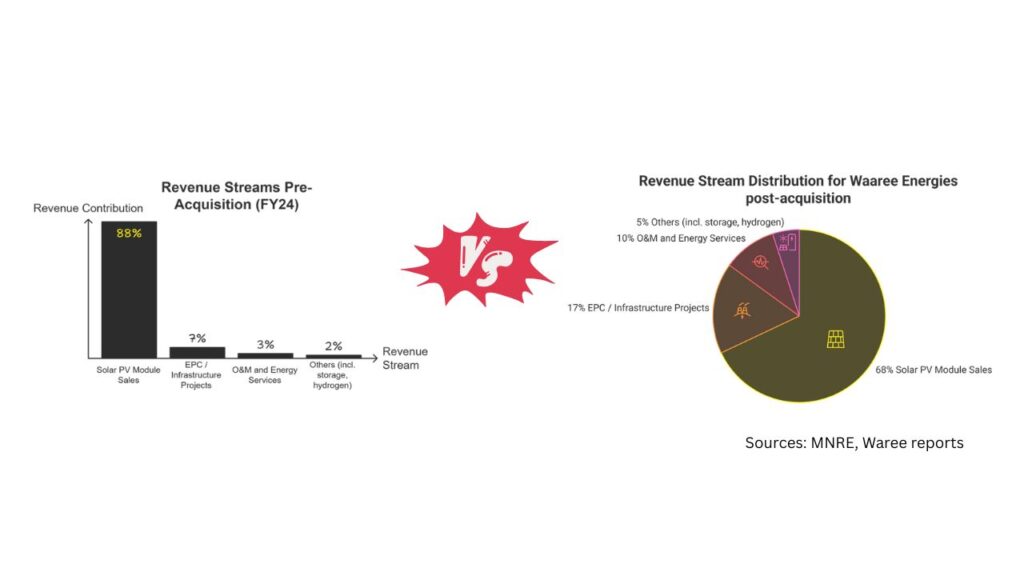

🔄 5. The Power of Diversification

Waaree’s acquisition of Enel Green Power India isn’t just a portfolio move—it’s a strategy shift.

Here’s how it expands Waaree’s reach:

- From manufacturing → project development + operations

- From solar-only → wind, hydrogen, and storage

- From commodity margins → infra-like steady revenues

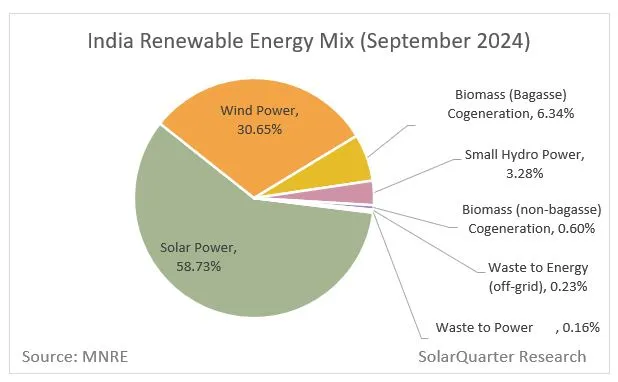

🚀 6. India’s Clean Energy Push: The Macro Booster

Let’s zoom out.

India plans to install 280 GW of solar capacity by 2030. That’s nearly 4x today’s levels. To get there, it’s:

- Offering PLIs worth ₹24,000 crore

- Mandating solar in new buildings, industrial zones, and smart cities

- Encouraging EV + solar hybrid rollouts

Waaree, with its 15 GW current capacity (and 20+ GW planned), is a natural beneficiary.

⚠️ 7. But What About the Risks?

Even solar superstars face cloudy days.

- U.S. exposure: Still uncertain. IRA incentives are shaky, and regulatory delays could affect exports.

- Domestic glut risk: 40% more solar module capacity is expected in India by end-2025.

- Valuation premium: Trading at 24x FY26 earnings, the stock is pricing in a lot of good news.

That said, Waaree’s proactive strategy, like its U.S. facility and DCR-driven positioning, gives it a cushion many peers don’t have.

🧭 The Verdict: Bright Future with Measured Optimism

Waaree Energies isn’t just another solar company—it’s shaping up to be India’s flagship in the global clean energy transition.

Why the stock is rising:

- Exceptional execution and volume growth

- Clear vertical integration strategy

- Smart geopolitical positioning

- Strong tailwinds from India’s policy push

- Revenue diversification through EPC and storage

What investors should consider:

- It’s not cheap—but the growth justifies the premium

- Risks are real—but Waaree’s strategy mitigates most

- Long-term horizon is key—this isn’t a quick trade, it’s a green energy compounder

👋 Final Thought: Solar is the Future—and Waaree is Riding the Sunrise

India’s solar story is just beginning. With the world shifting from fossil fuels to renewables, and India turning into a global hub for clean tech, companies like Waaree aren’t just participating—they’re leading.

Stay tuned. The sun isn’t setting on this stock any time soon.

P.S :- Want more such stock analysis, Comment down!