Picture This:

You’re dining at a global buffet.

The chef charges:

- Americans: ₹300 for biryani

- Indians: ₹80

- Canadians: ₹150

Which is, Kind ‘a fair because Indians have less money to pay than the Americans and Canadians.

Now an American Uncle storms in and says:

“Why should Americans pay ₹300 when others get the same biryani for less?

From now on, I pay whatever the lowest guy is paying. If India’s paying ₹80 — that’s my price too.”

Boom — that’s the Most Favoured Nation (MFN) policy for drug pricing.

It’s not about cooking cheaper biryani — it’s about forcing the chef to serve Americans at India’s prices, even if costs differ or margins collapse.

Quick Recap: What Is MFN in This Context?

Trump’s Most Favoured Nation (MFN) idea is simple in theory:

“If another country is buying a drug cheaper than the US — then the US should get that same lowest price.”

Translation in simpler terms:

If a pharma company sells a diabetes pill for ₹80 in India, it can’t turn around and charge ₹300 for the same pill in the US.

Don Uncle wants the India rate — minus the jet lag.

Sounds like a win for Americans, right?

Lower drug bills. More affordability. Big Pharma put on a leash.

But here’s the twist:

The US may be saving money — by tugging on India’s margins.

And India isn’t just any player here — it’s the world’s pharmacy and the #1 exporter of generic drugs to the US.

So when America starts copying India’s price tag…

India might feel the burn.

The Fallout

1. India Might Lose Its Pricing Power

If the US says, “We want your low prices too,” Indian pharma may be stuck with two options:

- Either keep prices low and earn less, globally;

- Or raise prices globally — and risk losing affordability at home

Either way, someone pays.

2. More Rules, More Scrutiny

When prices drop, scrutiny shoots up.

It’s like buying a ₹300 shirt for ₹80 — suddenly you start checking the stitching, the buttons, the brand tag.

That’s exactly what might happen with Indian pharma.

If the US gets drugs at Indian prices, they’ll want extra assurance on quality.

And that means:

- Stricter FDA inspections of Indian manufacturing units

(The FDA already does surprise audits — expect more of them, and tougher ones.) - Delays in approvals for new drugs or generic licenses

(Because now every low-cost pill comes with a high-cost checklist.) - Higher compliance costs

(Firms will need to upgrade processes, systems, maybe even hire more regulatory staff — all of which eat into profits.)

Big picture?

The US might save on the drug bill — but Indian pharma companies will end up paying the price in red tape, reputational risk, and rising operational costs.

3. Innovation Might Take a Backseat

Lower profits mean less money to invest.

- R&D could slow down

- India’s generics industry, which runs on volume, not fat margins, might lose its edge

The Silver lining:

While the prices droped, The demand could surge.

If US drug get benchmarked to cheaper Indian Prices, Big Pharma in the West might step back — because low prices = low profits.

And guess who steps in?

India Could become the go-to pharma ‘dabbawala’ of the World— reliable, fast, and affordable.

This could boost volumes for Indian exporters like Sun Pharma, Cipla, and Dr. Reddy’s.

Solving a paradox

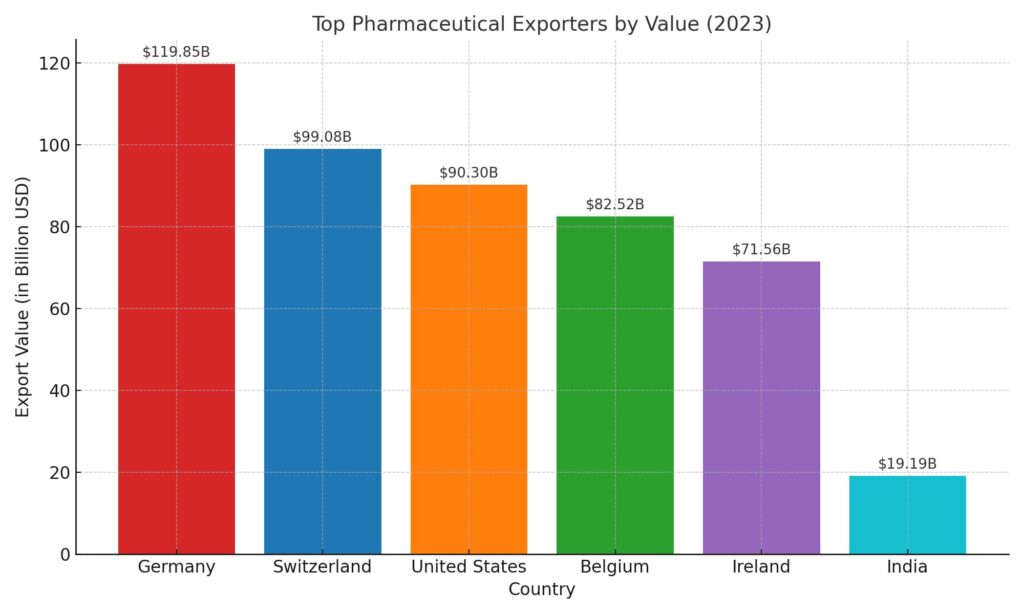

Did you know? Out of every 5 medicines in the world, 1 is manufactured in India.

Still, India is nowhere in the top medicine exporters’ list.

Note: India is not 6th Largest exporter, it comes 9th in the list. We have omitted some of the Countries to fit India into the graph.

The answer to this paradox lies in the Classic question of “Quantity vs Quality”.

India’s pharmaceutical industry primarily focuses on producing affordable generic medications, which are essential for many developing countries. This strategy emphasizes volume over high-profit margins.

Here’s where it gets interesting.

Low-margin generics are India’s comfort zone. But MFN might force Indian pharma companies to ask:

“How do we stop being just the factory — and become the lab too?”

This could trigger a shift toward higher-value segments like:

- Biosimilars (complex, copycat versions of biologic drugs)

- Specialty drugs

- Research-based formulations

Think of it this way:

India currently sells ready-made dosa batter.

Moving up the value chain means creating a signature masala dosa recipe — unique, high-value, and hard to copy.

The Finopsis Take

Trump’s MFN idea could hurt India’s pharma profits in the short run — no sugar-coating that.

But if Indian companies use this pressure to evolve — to scale smartly, diversify boldly, and innovate fearlessly — it might just become the plot twist that levels them up.

In start up lingo:

MFN could be India Pharma’s pivot moment.

But make no mistake: if the US suddenly wants Made-in-India drugs at Made-for-India prices — someone’s balance sheet is going to bleed.

Let’s hope it’s not ours.